Monetary Bizarro World

Once-in-a-Species

Written By Jesse Myers

From the mainstream’s viewpoint, when it comes to money… I live in Bizarro World.

You may not recall, but Bizarro World was the original comic book version of multiverse themes. In the 1960s, Superman had to deal with another Earth — eerily like ours — but where many details were the opposite of what we call normal. We’ll let Jerry Seinfeld explain it

Why do I live in Bizarro World when it comes to money?

In contrast to the conventional viewpoint, I don’t believe that money should be backed by governments. In fact, I think the only way a money can be long-term viable is if it is backed by no authority at all.

Elizabeth Warren disagrees with this notion

I realize how truly bizarre my stance sounds to almost everyone. For example, here’s Elizabeth Warren expressing her adamant view that unbacked money is thoroughly absurd.

There’s a lot to unpack here. First of all, let’s give Liz the benefit of the doubt — I believe she is genuine in her views and earnest in her attempt to explain why Bitcoin doesn’t make sense.

That said, no matter how much or how little you know about Bitcoin, you can sense that she is confused. She does not have mastery of the topic she is trying to discuss — though her performative confidence aims to obscure that fact.

In the first half of the clip, she strives to convey her version of reality: that money must be backed by something in order for it to have value. With every fiber of her being, she knows this to be true. And by contrast, Bitcoin is backed by nothing and therefore cannot have value – surely, if she just explains this to people, they will come to their senses!

Halfway through the clip, she aims to bring the conversation back from the Bizarro World of unbacked money and into the real world, where money is backed by something. She attempts to articulate how government-issued digital currencies (CBDCs) can leverage the technological advantages of digital money while imbuing them with the all-important backing of government authority. This is how the world works today, after all. And in her mind, a digital currency with the backing of the US Government is obviously superior to one without it.

Considering the inverse perspective

I have tried to remain fair in my presentation of the conventional view of money. And now, it’s time to consider the other side of the argument. It’s not that Bitcoin is the true opposite of the conventional view of money, just that in a few ways it feels truly bizarre — an inversion of what we’ve been taught as common sense.

First, the ethos underpinning Bitcoin patently rejects the idea that government authority strengthens money. The reason is that the interests of government conflict with the interests of currency users — everyday people living their lives and storing their savings in that money.

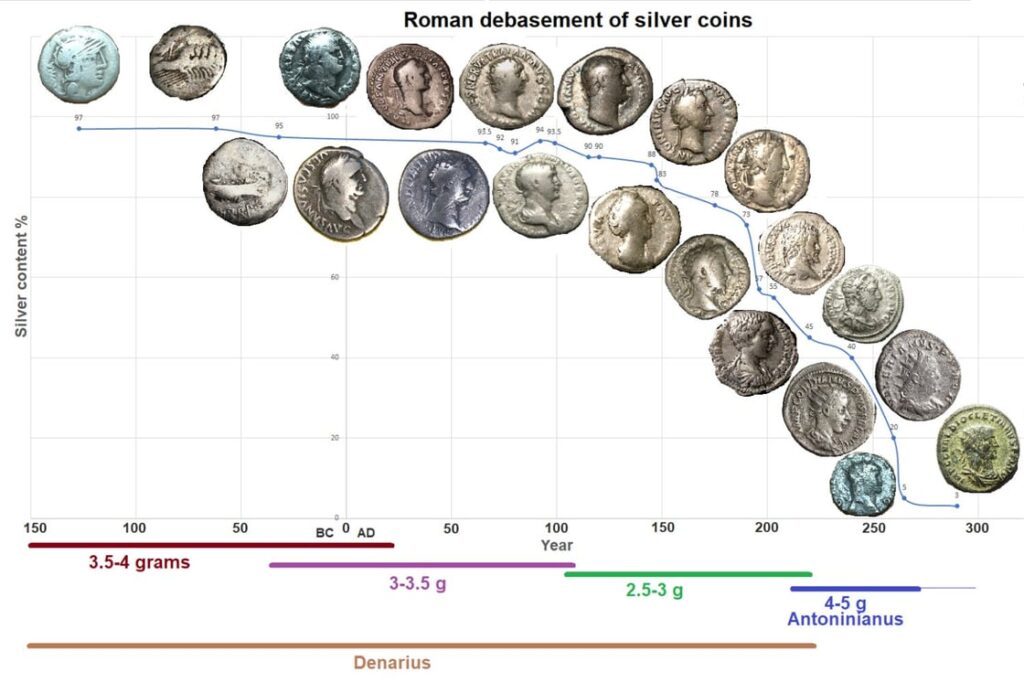

If a government has authority over a currency, they have the right to print more of a currency (diluting the purchasing power of existing holders). And indeed, that is the irresistible allure of controlling one’s own currency. History is replete with examples of governments addressing their problems through the convenient but myopic salve of creating more money out of thin air.

In ancient Rome, this meant melting the silver from 10 coins & spreading it across 11 new coins. Today, it’s even easier — the Fed just prints more dollars by changing some numbers in their computer.

Second, there are other disadvantages to allowing anyone to have authority over a money. These all come back to predictability & reliability. If a government (or anyone else) has authority over a money, they can change the parameters of that money. They can create more or less of it than before; they can tell you when or where you’re allowed to use the money; they can change the Terms of Service to use that money.

What I’ve just described is what Central Bank Digital Currencies (CBDCs) offer the world — more power and greater control for governments, reduced rights for users. A central authority turns money from a matter-of-fact bearer instrument (whoever possesses it, controls it) into a permissioned system of financial access — money with strings attached.

Money without government

So, printing more of a money harms the existing holders. And having an authority in control of a money impinges on the rights of existing holders. From the perspective of everyday users of a money, it would be best then if nobody could increase the supply of their money & nobody had authority over their money.

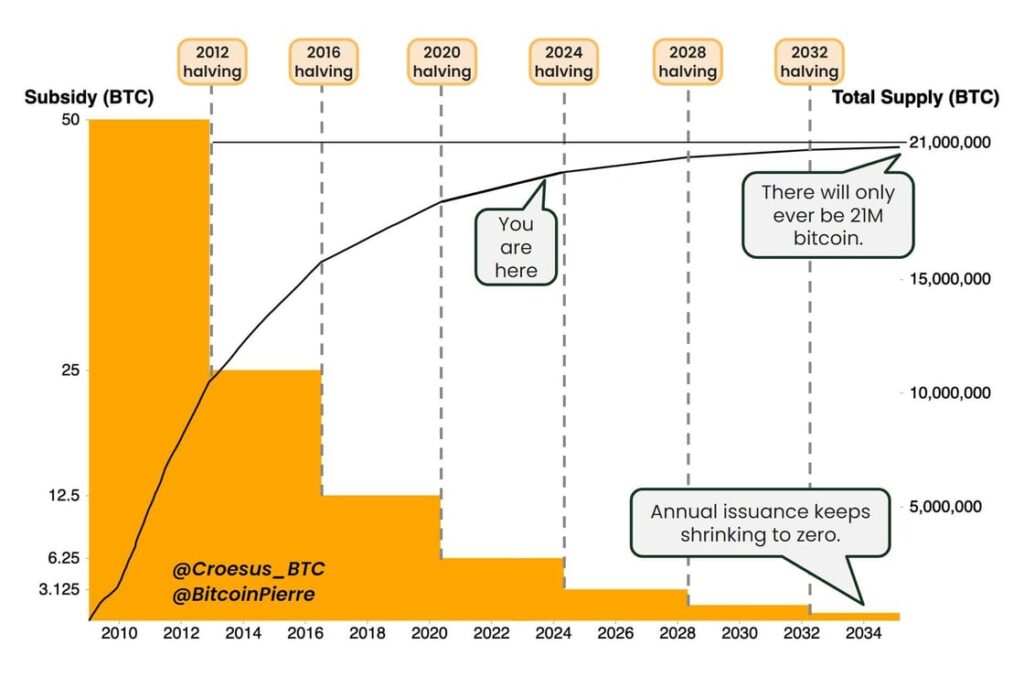

To take this to its logical conclusion, the ideal money would have a finite supply, be completely permissionless to use, and grant no authority the ability to change the rules. Sound familiar?

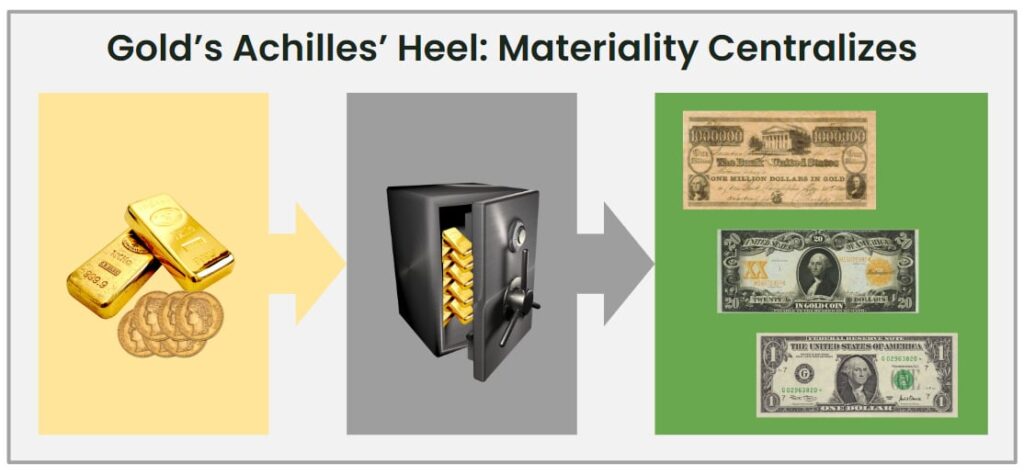

This shouldn’t be as radical of an idea as it sounds. The fact of the matter is that gold offered most of these properties, and that’s why it emerged as the preferred money for the world, through 6,000 years of the free market selecting for the money that people most wanted to hold.

But gold had an Achilles’ Heel — its materiality necessitated storage in vaults, which ultimately allowed centralized authorities (governments) the ability to control it & slowly shift the meaning of money over time.

Until 1971, the US Dollar was backed by gold. But now, it’s not. And yet, to this day, 30% of Americans still believe the dollar is backed by gold.

Which brings us back to Elizabeth Warren — she characterizes Bitcoin as unbacked, but what exactly is the dollar backed by?

Might makes right

The US Dollar is backed by “the full faith & confidence of the US Government.” Which is to say, it is backed by the government saying it’s worth something, punk. If this sounds reminiscent of a schoolyard bully imposing his will through threat of force, well… the U.S. Military will surely consider your objections.

But even if governments didn’t use their authority to debase the purchasing power of existing holders (they do), this system of government money backed by threat of force does not create the best assurances for end users (meaning, everyday people).

As formidable as it is, the U.S. Military is not all-powerful, permanent, or omnipresent. But there are a few things that are: math & self-interest.

Ideal money for everyday savers

From the point-of-view of everyday savers, the best money would:

Have a hardcapped supply

Have no authority in control

Have no ability to change the rules

Be protected by the universal laws of math

Incentivize savers to hold onto their money (via supply dynamics that cause the money to appreciate in purchasing power over time)

Now, doesn’t that sound like a pretty sensible system? One that puts the interests of holders first & protects them indefinitely via the unblinking steadfastness of math.

If such a system could leverage human self-interest via a reliable incentive to adopt and hold for the long haul, that would be a pretty great money from the point-of-view of people using it as a savings vehicle. And it would be a bad money from the point-of-view of governments seeking greater power & control over money.

What’s unfamiliar appears bizarre

The funny thing about Bizarro World is that the side that appears bizarre is just a matter of perspective. If you grew up living on a cube-shaped planet, you would think a spherical world was very weird.

You grew up living in a world where money is backed by threat of force (because this arrangement benefits governments). As a result, you think a money sensibly designed to serve the interests of savers is weird.

Perhaps, all this time, it’s you who has been living in monetary Bizarro World.

Onramp provides guidance and solutions for HNWI and institutional-level Bitcoin buyers and holders. To learn more, visit onrampbitcoin.com or schedule a consultation to chat with us about your situation and needs.