The Debt Whirlpool and the Bitcoin Lifeboat

Onramp is proud to bring you this report by Jackson Mikalic, VP of Business Development at Onramp and author of The Fiat Cave. This piece explores the high-level macroeconomic conditions that threaten retirees’ portfolios, and suggests how Bitcoin could be the lifeboat for the storm ahead. Enjoy!

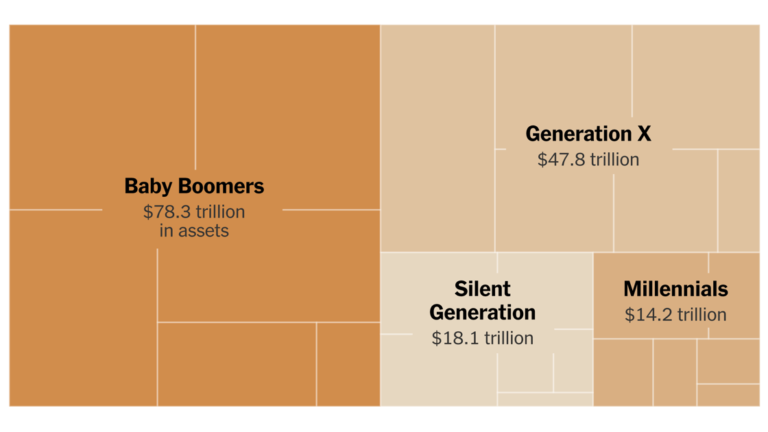

Boomers and Gen X own approximately $126 TRILLION of assets.

But despite their tremendous amount of wealth, they are in a precarious situation.

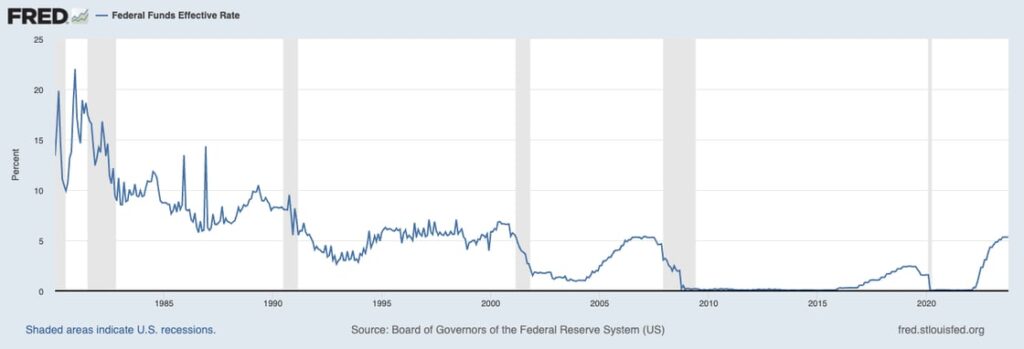

Much of their financial success can be attributed to the secular decline of interest rates from the 1980s to 2021, which was a tailwind for ever-increasing real estate, equity, and fixed-income valuations. During those decades, the 60/40 Portfolio was the standard retirement plan, which worked due to declining rates and negative correlations between equities and fixed income.

The Debt Whirlpool

Although their collective wealth is staggering, the investable landscape has changed materially. The tides that aided in their wealth creation have shifted. The monetary tsunami is coming, and much wealth will be lost at sea without a lifeboat.

Retirees have time to steer the ship around. But the clock is ticking. A failure to reallocate retirement funds to secure vessels [hard assets] will result in a leak of purchasing power over the coming years and decades.

Retirees could see their retirement’s real value (inflation-adjusted) deteriorate over time, leaving them without the financial life jacket they had planned for in their old age, a disastrous outcome for millions of people.

So what is the threat looming on the horizon? A fiscal storm impacting “safe haven” assets, in particular the US Treasury Bonds.

Retirees thought they could coast off into the sunset with their tried and true portfolio of equities and bonds, increasing their bond allocation as they age, as conventional wisdom suggests.

Increasing one’s bond allocation in retirement was once an effective strategy. With retirement comes a decline in earned income, often replaced by stable and income-generating assets such as US Treasuries. But now, these unassuming assets could risk capsizing the ship.

Ultimately, the imminent risk lies in the fiscal recklessness of the United States [the USS Uncle Sam]. The once sturdy and resilient ship is now sinking under its obligations, which have become insurmountable. Default via inflation is a certainty.

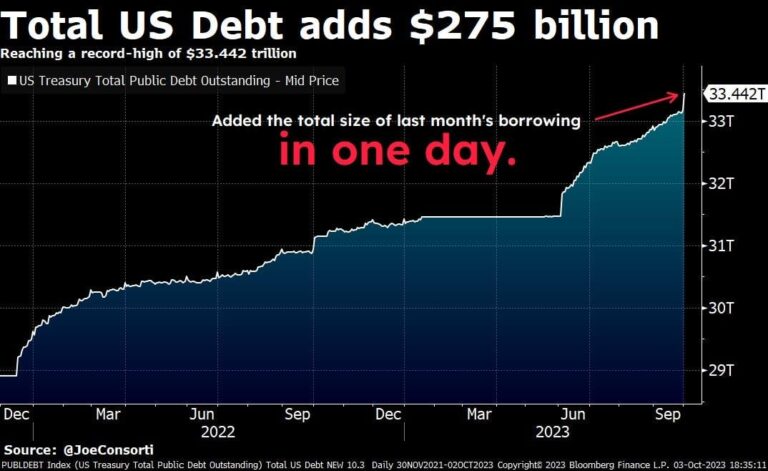

The USS Uncle Sam has accumulated over $33 TRILLION of National Debt. And earlier this week, in a single day, added $275 billion of debt. The crew [politicians] seem dead set on wrecking the ship with every billion dollars of debt further compromising its foundation.

For retirees, the implications are severe. The US Treasury Bond once thought of as the “safe haven asset,” is an IOU from an insolvent government. Not the lifeboat you were told it was years ago. The government continues to pile on debt, which can only be paid by issuing more debt – a Ponzi scheme.

The USS Uncle Sam is headed toward a debt whirlpool, set to destroy the savings of any vessel that approaches it. Without a lifeboat, retirees will experience dollar debasement due to exponential debt, crushing the real value of their savings.

In fact, it’s already begun. Long-duration Treasury bonds have now lost more in % terms than stocks did during the Great Financial Crisis due to the rapid interest rate hikes over the past two years. On top of these nominal losses is persistent double-digit inflation eroding the purchasing power of fixed income.

Each day, it seems more people become aware of the debt whirlpool on the horizon, yet many are still scrambling to find the lifeboat.

Get on the Bitcoin Lifeboat

It’s challenging to chart new waters. For decades, bonds were a suitable vessel to cruise through retirement. But just as skilled sailors adapt to changing winds and turbulent seas, retirees must adapt their financial strategies to the evolving landscape.

As the USS Uncle Sam faces the certainty of a debt whirlpool, retirees must set their sights on a new horizon — bitcoin. A secure vessel for savings offering a safe haven amidst the stormy seas of fiscal uncertainty.

Often compared to a digital version of gold, bitcoin’s value is derived from its scarcity, making it an ideal refuge for savings.

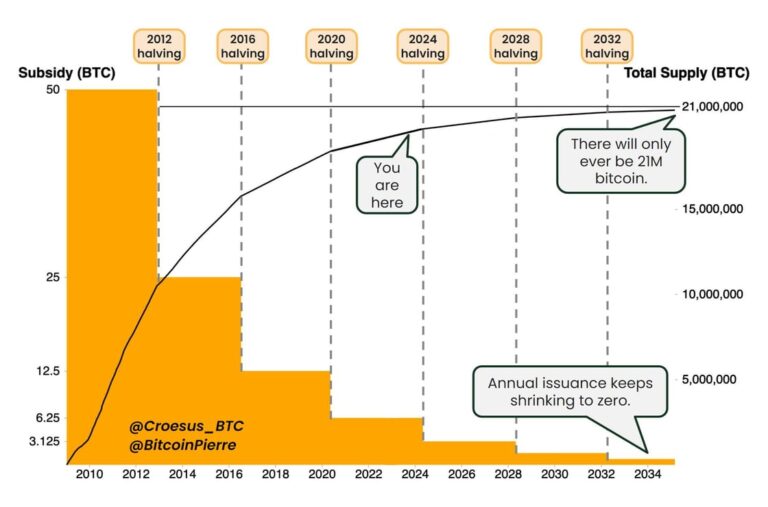

With a fixed supply of 21 million coins, bitcoin stands in stark contrast against the inflationary pressures threatening fiat currencies and sovereign debt. This scarcity is further accentuated by the halving mechanism, which reduces bitcoin’s inflation rate by half every four years, increasing its scarcity.

Despite bitcoin’s scarcity, which makes it a suitable store of value over medium (2-4) or long (5+) year time horizons, it still exhibits severe volatility in the short term.

Although the USS Uncle Sam is in a perilous situation, which will be devastating to bondholders over the coming years, retirees find themselves in a delicate situation, needing to balance short-term asset stability with long-term wealth preservation.

Fortunately, Bitcoin’s unique attributes make it an excellent counterpart to bonds.

A T-Bill may offer short-term stability and reliable income but will guarantee a reduction in purchasing power in real terms due to inflation over many years.

On the other hand, Bitcoin may decrease by 10% in a day or increase by 50% in a month, but its CAGR has been 20-150% annually, depending on the years you measure it. Bitcoin’s stellar long-term performance results from its absolute and increasing scarcity (decreasing supply) met by a rapidly growing international demand.

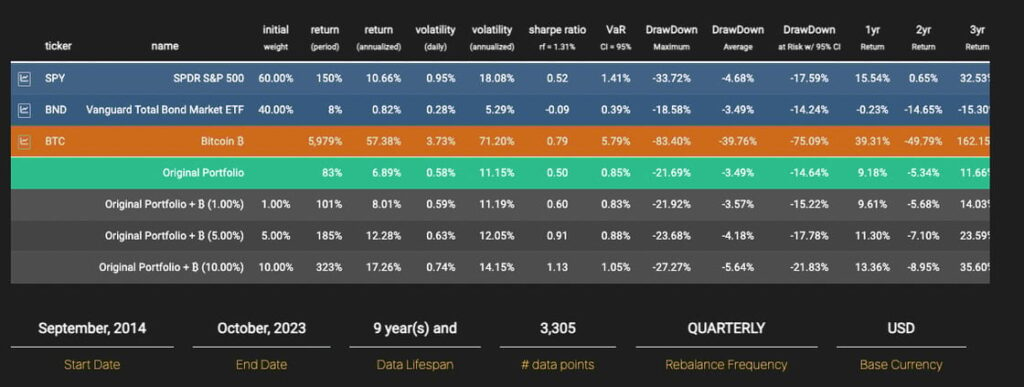

As retirees weigh their options, bitcoin’s role as a secure vessel for a part of their savings will become as clear as day. Incorporating bitcoin into a traditional retirement portfolio offers higher annualized returns with barely any increase in volatility – an increased Sharpe Ratio. (In this chart, check out the return (annualized), volatility (annualized), and Sharpe Ratio when adding a 1%, 5%, and 10% BTC allocation.)

Sadly, as the rate of fiat devaluation accelerates, the USS Uncle Sam’s shipwreck will become a reality – destroying the livelihoods of countless retirees.

Bitcoin offers security amidst the turbulent seas. It’s the lifeboat needed to protect hard-earned treasures and cruise peacefully into retirement.

Onramp provides guidance and solutions for HNWI and institutional-level Bitcoin buyers and holders. To learn more, visit onrampbitcoin.com or schedule a consultation to chat with us about your situation and needs.