Announcing:

ONRAMP INSURED PROTECTION: THE FIRST INSURED MULTI-INSTITUTION CUSTODY SOLUTION FOR BITCOIN

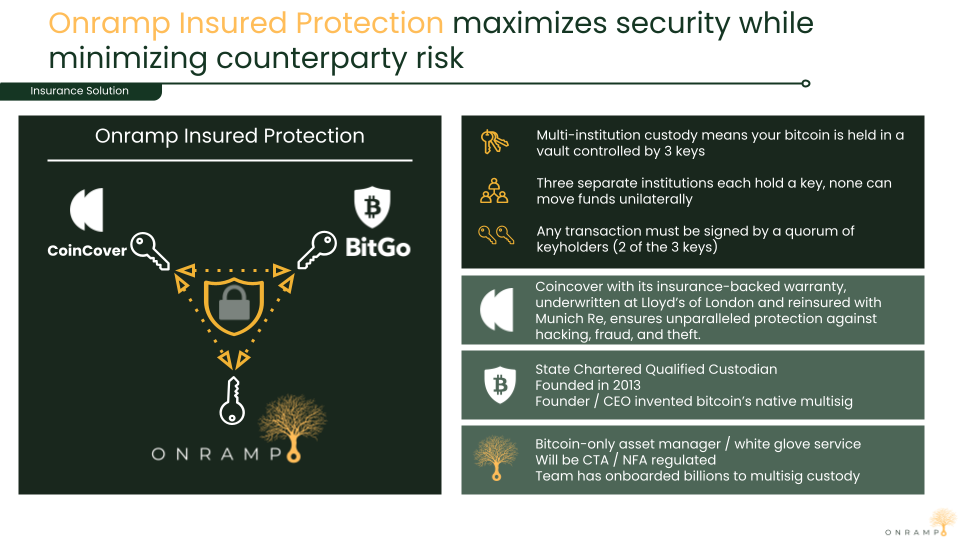

Today, Onramp is excited to unveil its latest improvement in bitcoin custody; Onramp Insured Protection, a segregated insured custody solution with multi-institutional oversight, set to redefine the standards of asset safety for clients.

The Next Evolution in Bitcoin Custody

Onramp has deepened our existing partnership with Coincover to offer an industry-leading level of security and assurance leveraging Lloyds of London and MunichRe. By providing institutional-grade insurance for segregated client wallets built on multi-institution custody, this approach enhances safety and brings resiliency to bitcoin custody.

Onramp Insured Protection represents an augmented version of Onramp’s Multi-Institution Custody Solution which incorporates Protected Co-Signing by Coincover, leveraging the Coincover Risk Engine to provide additional insurance-backed protection against risks such as human error and phishing attacks. This feature ensures that no transaction can be signed and executed without collectively meeting the stringent security criteria established by Onramp and Coincover.

Building Secure Solutions for a Maturing Asset Class

This development represents a pivotal chapter in the evolution of bitcoin into a mature, recognized asset class. Institutional investors, family offices, and high net-worth individuals who had been previously hesitant are now looking towards bitcoin as a viable component of their investment portfolios. The introduction of a product like Onramp Insured Protection reassures these investors that the asset class is maturing, with safety measures that parallel those found in more traditional investments.

“Multi-institution custody represents a major step forward for the financial industry, opening up trillions of dollars in capital that has been on the sidelines, ready for exposure to the most important asset of the last decade. By integrating fault tolerance and redundancies across multiple world-class institutions, our clients can now invest in bitcoin with the confidence that their assets are secure, significantly reducing the risk of their investment being wiped out due to choosing the wrong counterparty. With Protected Co-Signing with Coincover as a partner, we’re pushing the boundaries even further with a maturing asset class. Leveraging Coincover’s cutting-edge risk engine, key signing capabilities, and our partnership with Lloyd’s of London, we are able to add a crucial layer of insurance to our already superior custodial solution.” – Michael Tanguma, CEO at Onramp

As the bitcoin market matures into a key asset class for investors of all types, Onramp remains the industry leader by offering solutions catering to the needs of dedicated bitcoin holders, high net-worth individuals, family offices, and institutional investors. Insured multi-institution custody not only provides enhanced security but also offers redundancy to safeguard against the common failures of exchanges and other custodial solutions.

“Onramp’s insurance product with Coincover is designed to give our clients peace of mind, knowing their assets are managed with the security of multi-institution custody and insured against unforeseen risks,” added Mitch Kochman, Chief Revenue Officer at Onramp.

Looking Ahead

As bitcoin continues to carve out its place in the financial world, solutions like Onramp Insured Protection are vital, offering enhanced security and signifying the maturation of bitcoin as an asset class. For potential investors, this represents a turning point where they can now engage with bitcoin with confidence, allowing substantial capital to flow into bitcoin without the looming fear of catastrophic losses.

With this initiative, Onramp aims to pull forward the future state of bitcoin as an integral and stable part of investment portfolios. For those who have been watching from the sidelines, the message is clear: the future of bitcoin investment is here, and it is insured, secure, supported by multiple reputable institutions, and devoid of single points of failure.

Ready to secure your bitcoin legacy?

Onramp provides bitcoin investment solutions built atop multi-institution custody.

To learn more about Onramp Insured Protection and our full suite of products, please schedule a consultation to chat with us about your situation and needs.