3/7/24 Roundup: New All-Time High, Briefly

Onramp Weekly Roundup

Written By Zack Morris

Before we get started…if you want to learn more about multi-institution custody and its benefits for securing bitcoin for generations – connect with the Onramp team.

And now, for the weekly roundup…

- Bitcoin Touches New All Time High, Briefly Surpassing Swiss Franc as World’s 13th Largest Currency By Market Cap

- On-Chain Indicators Not Signaling A Top

- U.S. Department of Energy Walks Back Emergency Survey of Bitcoin Miners

$69,325

That was the tick that set a new all-time high for bitcoin in USD terms on Coinbase in early trading Tuesday morning New York time, although the achievement was short-lived.

Within hours of the new all-time high, bitcoin had fallen $10,100 (-15%), reportedly liquidating over $1 billion of leveraged positions across all digital assets.

Yes, we are back to $10,000 daily candles.

With USD checked off the list, the only remaining major global markets to not yet experience a new all-time high in their local currency are Switzerland (BTC/CHF), Brazil (BTC/BRL) and Mexico (BTC/MXN).

Due to the peso’s relative strength over the past few years, our neighbors to the south figure to be the last to reach new all-time highs, still 13% away as of March 6th:

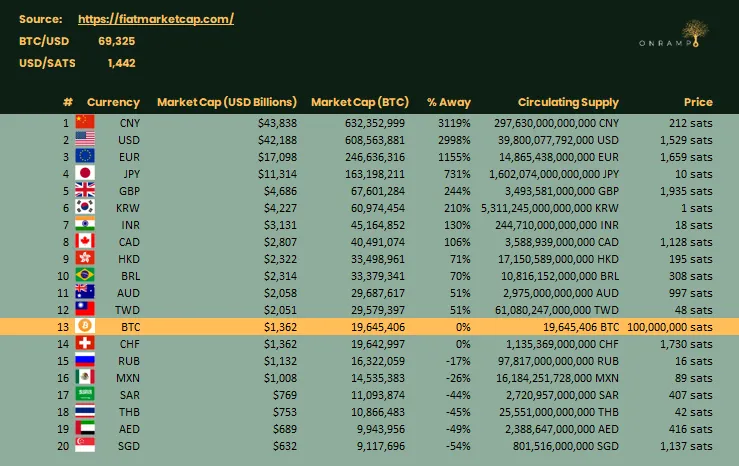

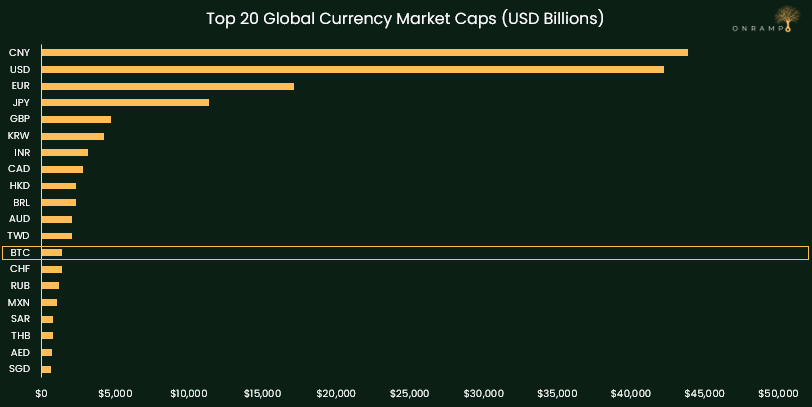

BTC may not have hit a new all-time high in terms of the Swiss franc just yet, but the Swiss currency did briefly give up its spot to bitcoin as the 13th largest global currency by market cap:

Perhaps it is a surprise to realize that bitcoin has surpassed such a currency as the Swiss franc, long treated as a safe haven and one of the strongest fiat currencies in the world, in market value.

But consider that Bitcoin has 51 million users (as measured by addresses with a non-zero balance), while the Swiss population stands at about 9 million. Or that the value settled on Bitcoin in 2023 was $1.4 trillion (down from $4.1 trillion in 2022), while the GDP of Switzerland was $825 billion.

Viewed through this lens, perhaps the most surprising aspect of bitcoin flipping the Swiss franc in market cap is that it has taken as long as it has.

On-Chain Indicators Not Signaling A Top

Despite the all-time high and maybe some pockets of euphoria on X, a look at popular on-chain indicators suggests that the rally has legs.

MVRV Z-Score is a measure of bitcoin’s current market value relative to its cost basis, or cumulative capital flow into the asset.

While the MVRV Z-Score has breached 3, no prior cycle tops have occurred without it hitting at least 7, as indicated by the bottom of the red band in the chart below:

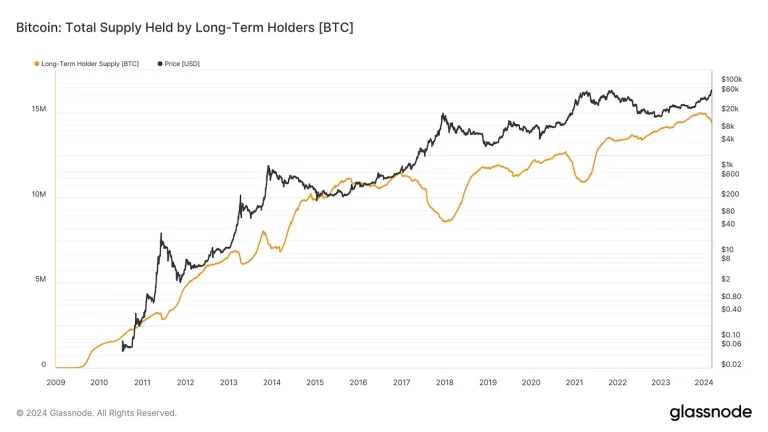

While long-term holders (coins not moved in over 155 days) have begun distributing, as shown in the top chart below, if we zoom out we can see that the supply held by long-term holders is still near all-time highs and the current levels of distribution does not yet mirror what we saw during the 2017 and 2021 prior cycle peaks:

DOE Walks Backs Emergency Survey of Bitcoin Miners

Domestic bitcoin miners were granted a restraining order by a judge in their lawsuit to stop the U.S. Energy Information Administration (EIA, an arm of the Department of Energy) from exercising an emergency authorization to collect data on the energy usage of companies operating in the space.

After the EIA’s emergency survey was issued on January 31st, the government agency was sued by the Texas Blockchain Council and bitcoin miner Riot Platforms, who argued that the survey violated the Paperwork Reduction Act and that some of the information requested was competitively sensitive.

Following the court battle, the EIA has discontinued their collection of data under the emergency authorization and has said it will destroy all information that has already been collected. Instead, the EIA will publish in the Federal Register a new notice of proposed data collection with a 60 day comment period.

The court win comes as a brief respite for the industry as fears over the politicizing of energy use for bitcoin mining and AI data centers have begun to seep into the discourse in the wake of the EIA’s overreach.

Chart of the Week

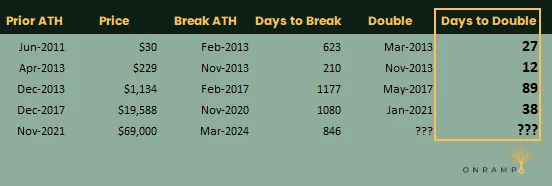

Inspired by this post from Dylan LeClair:

On each of its four previous breaks of all-time-highs (disregarding the November 2021 double-top break of the previous May 2021 all-time-high), the bitcoin price has doubled in as little as 12 days (on the November 2013 break of previous ATH), and no more than 89 days (February 2017 break of previous ATH).

Quote of the Week

“There’s one other interesting dynamic at play here. Most manias tend to end when supply just overwhelms the demand … The interesting thing about Bitcoin is there’s no new supply that can come online for Bitcoin. In fact, the current rip is reducing the Bitcoin supply.”

“As bitcoin’s price goes up, advisors who have allocated to bitcoin outperform, letting them poach clients from advisors who haven’t and creating pressure on other advisors to open some allocation to bitcoin. In the short term, that’s a perpetual motion machine.”

— Andrew Walker, Portfolio Manager at Rangeley Capital and self-described bitcoin skeptic, Yet Another Value Blog, March 4, 2024

Market Update

as of 3/6/24:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Bitcoin continued its rally and finished the week up 8.2% after briefly eclipsing all-time highs earlier in the week. The asset has now tripled in the past year. Stocks were mostly flat as the market digested a number of executive presentations at the Morgan Stanley Tech, Media, and Telecom Conference in San Francisco, the largest TMT investor conference of the year. Gold spiked 5.5% and looks to be breaking out of a 3.5 year trading range, perhaps anticipating new liquidity measures to respond to renewed banking sector woes as New York Community Bank did an emergency $1 billion capital raise. Oil rallied in response to news of extended OPEC production cuts, before consolidating and finishing the week up 0.6%. Yields fell and bond prices rose 1.3%.

Podcasts of the Week

The Last Trade E040: Contrarian Thinking with Allen Farrington

In this episode of The Last Trade, Allen Farrington joins hosts Marty Bent, Jesse Myers, and Michael Tanguma to discuss bitcoin ETFs, nation-state adoption, bitcoin-only venture, deflationary tech, shifts in the asset management landscape, the future of bitcoin custody & more.

Scarce Assets E005: The Game of Wealth with Mark Moss

In this episode of Scarce Assets, Mark Moss joins hosts Andy Edstrom & Jesse Myers to discuss the multidisciplinary nature of bitcoin, the DNA of scarce assets, risks/opportunities in a debt-based monetary system, inflation, debt cycles & more.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris